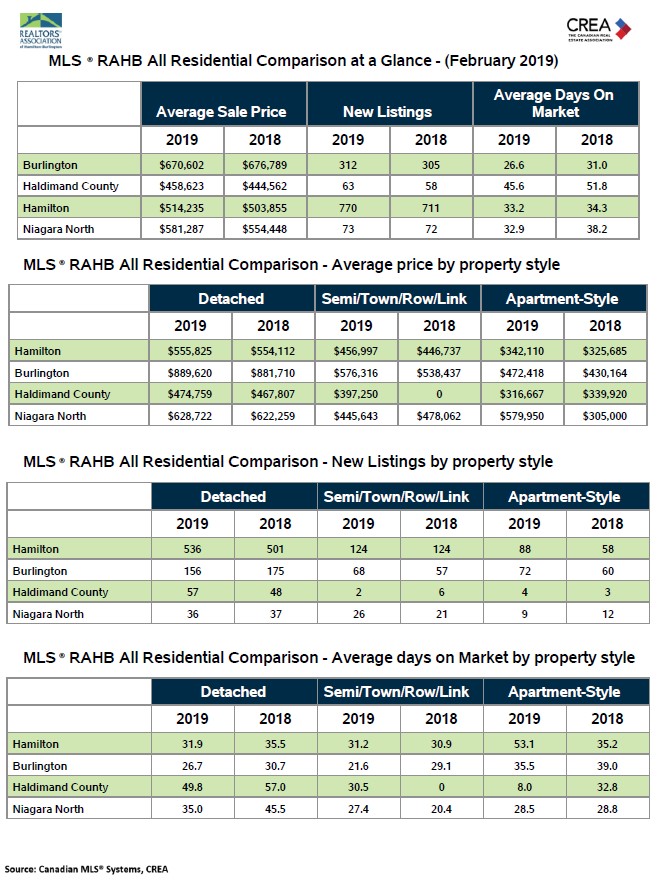

Hamilton, ON (March 1, 2019) – The REALTORS® Association of Hamilton-Burlington (RAHB) reported 735 sales of residential properties located within the RAHB market area were processed through the Multiple Listing Service® (MLS®) System in February, 2019. This is a 4 per cent drop from February last year; however, a 24 per cent increase over January 2019. The average price was up from February 2018 by 1.9 per cent to $557,135.

“Last year this time we saw the beginnings of a more balanced market,” says RAHB CEO George O’Neill. “The data for January and February is trending upwards and could lead into a healthy spring market for both buyers and sellers.”

The number of sales for single family properties within the entire RAHB market fell by 2.9 per cent compared to the same month last year, and the average sale price decreased by 0.7 per cent. Townhouse sales activity across the entire RAHB market area was also down from February 2018 by 4.2 per cent, while the average townhouse sale price rose by 4.9 per cent. Apartment-style property sales decreased by 6.2 per cent over February 2018, and the average price increased by 11 per cent to $413,801.

“The trend for the past few months has been that more affordable properties and communities have been seeing gains, but this month the statistics vary regardless of type of property and location,” notes O’Neill. “The numbers can change from one month to the next, and that’s why it’s best to work with a local REALTOR® when buying or selling. They know their communities and have access to comprehensive data throughout the month.”

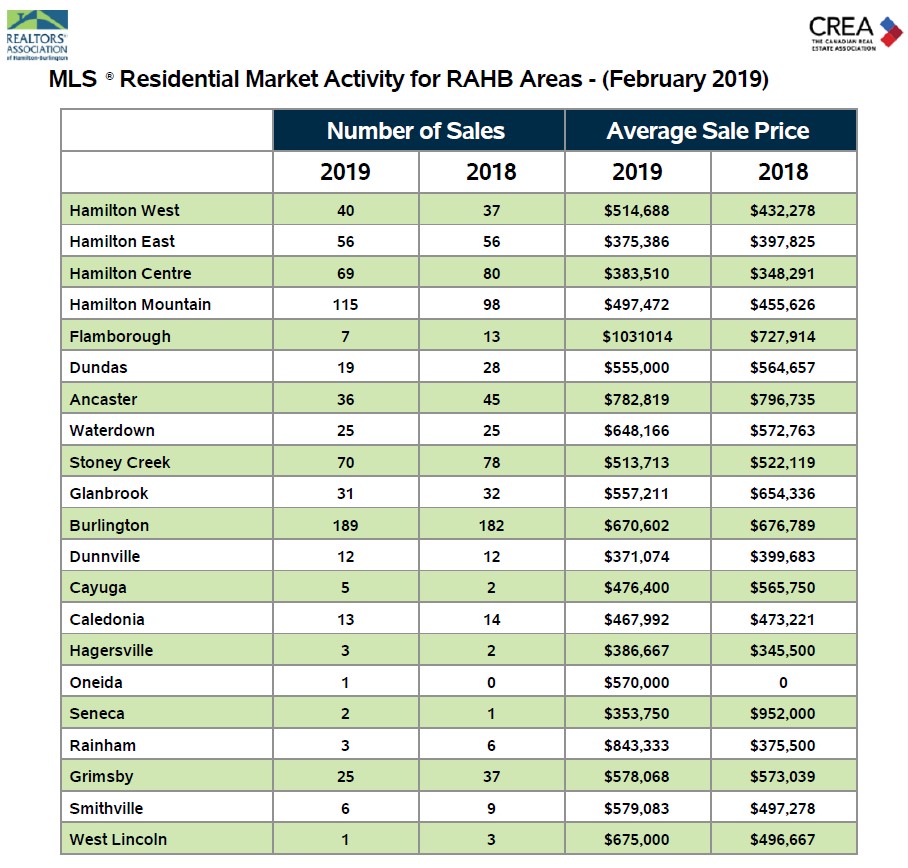

Specific neighbourhoods within the overall RAHB market area see results that often differ from the average of the entire RAHB market area. Because neighbourhoods vary, determining the right price and conditions when buying or selling a property can be challenging. Local RAHB REALTORS® have the experience, knowledge and tools to help buyers and sellers make those big decisions.

*Average sale price can be useful in establishing long-term trends, but should not be used as an indicator that specific properties have increased or decreased in value. Talk to your local REALTOR®.

– 30 –