Source: https://www.urbaneer.com/blog/how_to_rent_your_toronto_investment_property

Written By: Steven Fudge

No question, in the past 17 months we’ve experienced a seismic shift in the Toronto rental market that no one saw coming, which is creating unique challenges for landlords and tenants. Much of that falls squarely on the impact of the pandemic; COVID-19 has created shifts and fissures in the Toronto real estate market significantly, as I write about regularly in my COVID-19 & Toronto Real Estate series.

If you’d like to read an in-depth recount of what happened to the condo and rental markets, read, Dear Urbaneer: What’s Up With The Toronto Real Estate Rental Market, but here’s the short version about what happened during 2020 and the rental market specifically.

Along with changes to Airbnb rules (here’s my post called So Why Are There New Airbnb Regulations For Toronto?), the flow of immigration stemmed from border closures, the rise in the ‘work from home’ office, and the resulting need for more living space, the closing of many businesses and the resulting job losses, plus post-secondary education moving online for the academic year in most cases, demand has waned substantially for rental properties since we first experienced lockdown in Canada in March 2020. Meanwhile, the amount of product for rent has increased significantly – widening the gap – with Airbnb hosts turning to the long-term rental market and numerous condominium projects purchased by investors reaching completion.

And so what had been a razor-thin vacancy rate for some time in Toronto, seemingly overnight has shot directly upwards; it heightened the competition to secure a credible tenant.

In early 2020, this article from the Globe and Mail, “Toronto Apartment Vacancy Rates Spike To Record High, Monthly Rent Plunges“, summed up the rental market situation quite well. They cited statistics from Urbanation that showed how apartment vacancies rocketed to 5.7 percent at the end of 2019 year (it was 1.1 percent by December, while it had been under 2 percent for over a decade). This, unfortunately, was the highest the rate has been in 50 years.

Consequently, rents fell sharply. Apartment rents decreased by about 10 percent, year-over-year, and condo rents dropped by 14 per cent in the City of Toronto. For most of 2020, with the shadow of COVID-19 over their heads, landlords struggled to find a balance between making a profit on their investment and pulling in enough interest to find tenants that would stay and take good care of their properties. Some chose to shutter their properties completely until the situation improved. And here we are!

With a majority of Torontonians now vaccinated, 8 months into 2021, demand for rental properties is beginning to rise again and rents are trending upwards! Landlords are readying their investment properties to show at their best – and taking the time to find quality tenants!

Here’s our advice.

The Road Ahead: 2021 And Beyond

Most analysts concur that the blip of low interest in rentals and high vacancy rates was a blip in a longer-term trend. Some cited a return to Toronto norms by early 2021 (did not occur) while others believe the curve will be slower, reaching normal heights by fall 2021 or Spring 2022. Now that most Canadians have received their vaccinations, the risk or return of the Coronavirus has been minimized. However, we are still hearing reports of a 4th wave, which may yet delay the population at large returning to their work environments and engaging in the amenities that urban living provides. And although the Work From Home movement is likely to be a change that sticks with the professional class the most, we are inherently social creatures by nature, so there will be a desire by many to return to our previous familiar ways of life.

Similarly, the borders will re-open. Immigration will resume. The retail, fitness, food, and entertainment industries will resume in capacities as they once did, or similar. And with these, the appetite for rental housing in Toronto will reignite and rebound.

Below are two articles from BlogTO and NOW Toronto, predicting what is forecast for the Toronto rental market in 2021. Now, in August, it’s easy to see how accurate their predictions were and where they missed the mark.

“Toronto Real Estate Experts Say Now Is The Time To Rent A Condo Before Prices Go Up Again” – and – “Toronto Rent Prices To Drop In 2021 And Rebound In 2022: Report.”

Depending on where your investment property is located, its size and condition, and what features it has which makes it unique against your competition, few vacancies and a slow but sure decline in supply mean that, as a landlord, now is the time to dust of those rental contracts and start employing a sound, proactive strategy to place tenants in their investment properties.

It should be said that as the market has not recovered completely, some landlords may choose to consider offsetting the high carrying costs with whatever supplemental income they can generate (taking a lower price per month than their property would have demanded back in 2019, to mitigate the financial losses. Others depending on the calibre of their rental, will should be able to acquire a monthly sum closer to what they were expecting before the pandemic hit.

Be Aware Of Policy

Even beyond market conditions, being a landlord can be challenging. Back in 2018, I wrote, The Other Side Of Rent Control And Toronto Real Estate, when the rental market was in a very different situation. I talked about a number of issues, including how rent control was updated with the Fair Housing Act of 2017 to close loopholes and to create more affordable housing. While rent control in spirit does accomplish these, there are many who interpret rent control measures to favour tenants, especially from an investment and ROI standpoint for the landlord.

Now more than ever, it is advisable to be well versed with rules and regulations governing landlords and tenants. Refresh your familiarity with the Residential Tenancies Act, especially the rules and regulations that have come about during COVID-19. For instance, enforcement of evictions has been temporarily paused in order to “ensure that people are not forced to leave their homes while the provincial declaration of emergency is in effect”. It would be wise to consult the Landlord and Tenant Board (LTC) often for up-to-date information. Their FAQ portion of their website in particular is very helpful.

The key message I’m imparting here is that knowledge is power, especially when it comes to policy and regulations – many of which could either help or hinder your efforts to conduct your business as a landlord. It’s advisable to have your finger on the pulse of policy.

Beyond doing research and understanding market dynamics to help you manage your property investment well, here are some helpful, tactical tips to assist in leasing your property and finding tenants that fit in well with your lifestyle and objectives as a landlord.

Never Underestimate The Power Of Excellent Property Promotion

The search for ideal tenants starts with a powerful property promotion.

The presence of COVID-19 has reduced in-person viewings, which is why marketing your property is more important than ever – to make your process more efficient and, ultimately, successful. It is helpful to know your target market, and where they might be most likely reached. Does your prospective tenant live on social media? Which apps are their favourites?

When it comes to promoting the property itself, details matter. Much like when you are trying to sell a property, you must present your property in its best, most alluring light to draw tenants without misrepresentation. In this respect, small steps can yield big results. Before listing, have a deep clean done professionally of your property. Don’t forget the appliances – including the inside of the oven! A fresh coat of neutral paint will make any space feel brighter and fresher – and communicate that it has been well cared for.

Professional photography is a real plus, and can best demonstrate the benefits of your rental, showing the proportion of space, lighting, and more. Poor photography can really do your property a disservice and may deter people from considering your listing – in error! Overconfidence is snapping photos with your Pixel or iPhone may not serve you well, here.

At Urbaneer, we have a uniquely tailored approach to help landlords promote their properties. It’s all about exposure. We advertise your property on MLS/Realtor.ca and also advertise through a number of other avenues where prospective tenants are looking for leases, like Facebook Marketplace, Craigslist, Kijiji (paid promotion using top ad or banner as required), Viewit.ca, Padmapper, and Zumper.com. We also tap into social media, with listings on Urbaneer.com, and Urbaneer’s Facebook page, Instagram, and Twitter feed, including sponsored promotions.

We develop a comprehensive feature sheet to promote your rental property because every dwelling tells a story. We focus on the benefits of the property itself and communicate key features, but also highlight the location, amenities, and area benefits.

Just like a purchase, where a rental property is located often ranks high for tenants, which is why being informed on current area amenities, like green space, essential food, and retail locations, help promote the convenience of your dwelling. In the heightened restrictions associated with lockdown, of great importance to prospective tenants is what is available in proximity to the front door of the property, as much as to the features inside. As a landlord, you will be well-served to raise awareness around neighbourhood amenities and resources.

In fact, we have found focusing on the benefits of nearby amenities is critical in a challenging market. This approach was the cornerstone of our sales and marketing program for our seller client’s condominium in West Queen West where there was a lot of competing supply. We documented this in our post called How Urbaneer’s Tailored Toronto Real Estate Marketing Sold This Condo During The Pandemic.

We also provide support with showing feedback and help with offers, tenant reference/background checks and help with closing tasks.

The Interview

Once you’ve received interest in your property, it is time to find the right tenant. One of the most important steps in finding quality tenants is asking the right questions. Treat the process like a job interview. Feel free to add questions about behaviours and traits in a tenant that matter to you, but here is a good list to work from:

• Do you currently rent, and if so, where?

• How long have you lived in your current home?

• Why are you looking for a new place to live?

• What date would you want to move in?

• What kind of work do you do?

• What is a rough estimate of your income?

• How many people would be living with you?

• How many people living with you smoke?

• How many parking spaces would you require if you rent here?

• How many pets do you have?

• Do you think your current landlord will give you a favorable reference?

• Does your current landlord know you are thinking of moving?

• Have you ever had an eviction?

• Are you familiar with our rental application process?

• Have you filed for bankruptcy recently?

• Would you be able to pay the security deposit of ($ amount) at the lease signing?

• Are you willing to sign a 1-year lease agreement?

• Do you have any questions for me about the process?

Past behaviour is often predictor of future behaviour, which is why you enquire about things like bankruptcy, eviction history, and references. You can also gauge tenant lifestyle with questions around smoking, pets, guests, how many people would be living there, etc.

Keeping Good Tenants

It goes without saying, but finding quality tenants is crucial to making your property investment viable. This projected success is increased if you can retain those tenants for the long term.

Have you read my past post: Dear Urbaneer: How Do I Find And Keep Good Tenants? In it, I offer some helpful tips on the process of landing quality tenants, including ideas for advertising and staging properties for lease.

Once you’ve signed a tenant, how do you maintain them for the long term? Reducing tenant turnover is preferable. A long-term tenant represents long-term, steady income, without the costs associated with marketing and advertising your property. You can also forgo the hassle and work of landing new tenants repeatedly. There is also the possibility that a longer-term tenant may be more inclined to take greater care in using the property.

Like so many things in a successful business, it comes down to building relationships. Make sure that you offer open lines of communication to your tenant. Many issues can be resolved before they become problems simply by discussing them ahead of time.

Be timely with repairs and maintenance. Not only will this help to preserve the integrity and state of your property investment, but it also communicates that you are invested in your tenant’s happiness and comfort as well. It’s even better if you fix things before they get to the point where they are broken. Being proactive goes a long way.

As a rule of thumb, be reasonable with rent collection. If there is a short-term problem (which has emerged more commonly during COVID-19 due to job losses and income interruption) that might be temporary, be accommodating. It goes far in establishing that relationship that will encourage tenants to stay put.

This article from the Toronto Star “Thinking Of Renting Out Your Condo, Basement Or House? Two Experts Have Crucial Advice On How To Avoid A Disaster” offers sage advice.

Securing a tenant who is seeking a rental with a specific exit date in mind may serve you better for the long term. After all, given we anticipate the rental market to improve moving forward, you may be able to realize a higher rent within the next 6 to 12 months. This is particularly important for those who own properties that were completed pre-2018 that are bound by Ontario’s rent control guidelines. If you rent to a tenant who has a pre-determined exit date you may find you will be able to garner a higher rent at that time which will be greater than the rent guidelines prescribed by the province annually.

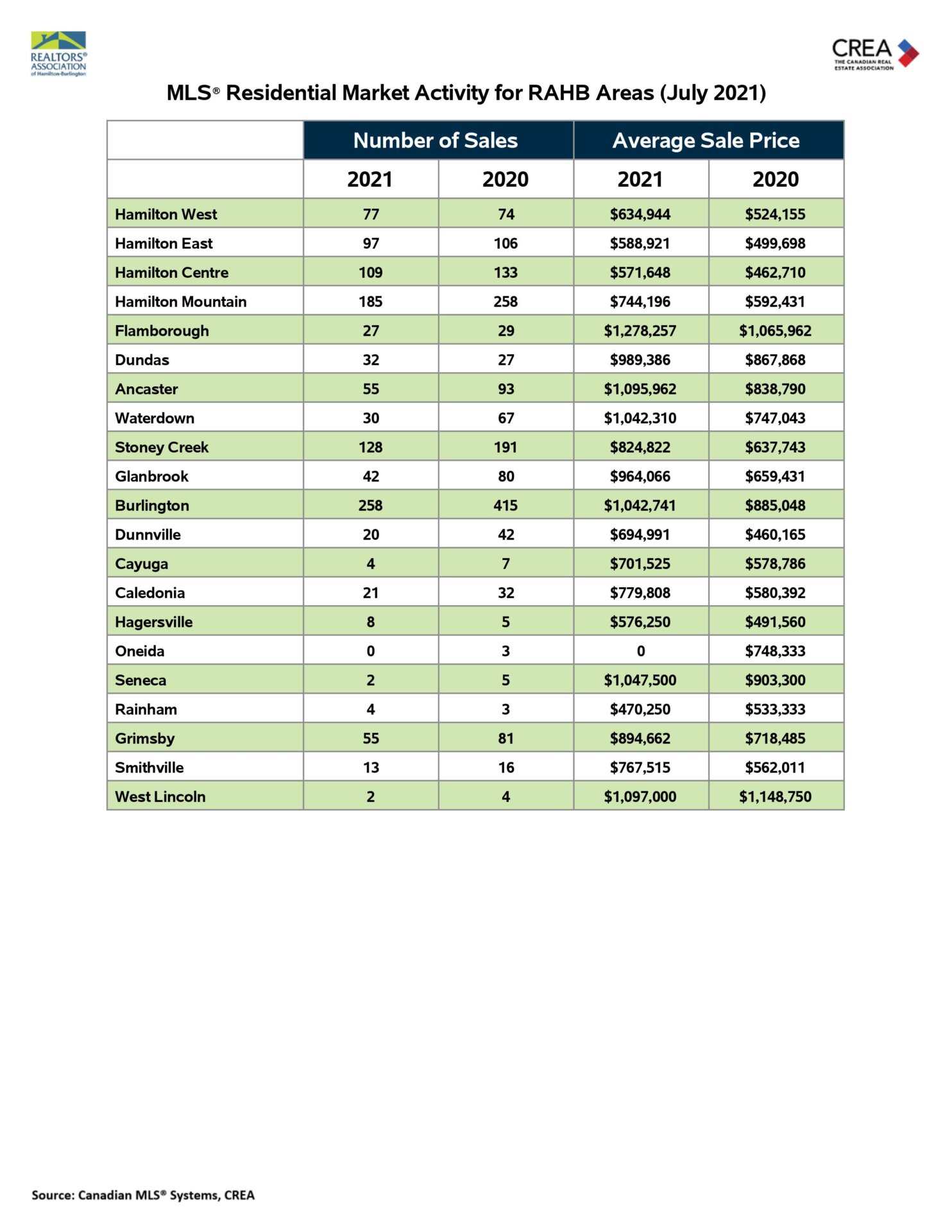

The number of sales of townhomes in the RAHB market area decreased by 26 per cent in July 2021 compared to June 2021. The number of new listings of townhomes was down 20 per cent, and the average sale price increased by two per cent to $735,606 from last month. The number of active listings for townhomes has increased by two per cent compared to June 2021.

The number of sales of townhomes in the RAHB market area decreased by 26 per cent in July 2021 compared to June 2021. The number of new listings of townhomes was down 20 per cent, and the average sale price increased by two per cent to $735,606 from last month. The number of active listings for townhomes has increased by two per cent compared to June 2021.